Why Miory distriсt

Miorsky district was formed on January 15, 1940, located in the north-west of the Vitebsk region and the Republic of Belarus, borders on the Braslav, Sharkovschinsky, Glubokovsky, Polotsk regions, the Republic of Latvia.

Area 1780 square kilometers. 20% of the entire territory of the district is occupied by forests, mainly spruce, pine and mixed. A natural monument of republican significance is the "Pure Oak Tree" in the Yaznensky Village Council.

Miorsky district is a corner of the Belarusian Lake. There are 96 reservoirs in the region, including 83 lakes. The largest is Obsterno with an area of 9.35 square meters. km And a depth of up to 12 meters, the deepest is Sumovka (29 meters). Of the 16 rivers flowing through the district, the largest are the Western Dvina and its tributary Disna.

About 17% of the territory is occupied by swamps. The largest headland in Europe "Yelnya" with an area of 20 thousand hectares. It is famous for the remains of the post-glacial tundra. More than 30 species of plants and animals listed in the Red Book have been preserved here. The national landscape reserve "Yelnya" is one of the most unique objects of the reserve fund of Belarus. "Swamp-Moss" - a hydrological reserve of republican significance

The population of the Miorsky district in 01.01.2023 is 17963 people. 9,300 people live in cities, including 7,900 in Miora and 1,400 in Disna. The rural population is 9,800 people.

Administratively, the district is divided into the city of Miory, the city of Disna, 9 village councils, 442 settlements.

The industry of the Miorsky district is represented by large enterprises that specialize in the production of meat and sausage products, concentrated feed, bakery and confectionery products.

The plant for the production of metal sheet and white tin in Miory is the only producer of tin of electrolytic tin and cold rolled sheet in the Republic of Belarus, which will occupy a worthy place among the producers of white tin in the CIS and Europe. This investment project is one of the largest implemented in the Vitebsk region.

The uniqueness of the new plant lies in the use of modern, energy-saving, environmentally safe equipment and technologies that allow producing highly liquid quality products with minimal costs.

The plant was built on a production site located in the immediate vicinity (within 1 km) of the city of Miory, Vitebsk region of the Republic of Belarus. The total area of the production complex located on a land plot of 40.2 hectares is about 200,000 square meters. The mission of the Miore Metal Rolling Plant is to produce competitive and best-in-class white tin for consumers of Belarus, CIS countries, Europe, Asia and America.

Agriculture and industry deserve priority attention with regard to the prospects for the development of the region. Agricultural enterprises are the main source of raw materials for the industrial enterprises of the region, which produce popular goods for the general population. In addition, most of the able-bodied population of the region works at these enterprises.

The production of rolled metal is especially promising, since, along with the main production, it is possible to develop various related industries, the emergence of entrepreneurial initiatives that will contribute to the wider socio-economic development of the Miorshchina.

It is especially promising from the point of view of the development of private business and entrepreneurship to expand tourism services in the region. The most popular are agroecotourism, health and environmental tourism.

The economy of the Miorsky district is extremely attractive for investors, there are many areas for opening and conducting business, developing infrastructure and promoting the economic, environmental and tourist potential of the region.

Resources

Miorsky district is located in the north-west of the Vitebsk region of the Republic of Belarus.

26.5% of the district's land is occupied by forests, mainly spruce, pine and mixed. About 17% of the district is occupied by swamps. The largest headland in Europe "Yelnya" with an area of 20 thousand hectares. famous for the remains of the post-glacial tundra. More than 50 species of plants and animals listed in the Red Book have been preserved here. The national landscape reserve "Yelnya" and the hydrological reserve "Swamp Mokh" are one of the most unique objects of the reserve fund of Belarus, create ideal conditions for the development of sanatorium-resort and rural destinations in tourism.

In the Miorsky district, valuable environmentally friendly mineral complex sapropel fertilizer is mined. The main mineral resources also include peat, construction sands, clays, loam.

Miory region is agricultural land on which grain and fodder crops, flax, rapeseed, potatoes are grown. The area of agricultural land is 66 thousand hectares, of which arable land - 36.2 thousand hectares, meadow land - 29.8 thousand hectares, including improved - 23 thousand hectares. Arable land score - 26.8. Marsh and forests are rich with berries, here collect an eco-friendly cranberry, cowberry, bilberry, blueberry, raspberry. The potential of the region is huge, there are ideal conditions for the production of environmentally friendly bioproducts, medicinal raw materials for export within the framework of commodity networks of investors.

Miorshchina is a lake region rich in water resources. There are 96 reservoirs in the region, including 83 lakes. The largest is Obsterno with an area of 9.35 square meters. km And a depth of up to 12 meters, the deepest is Sumovka (29 meters). Of the 16 rivers flowing through the district, the largest are the Western Dvina and its tributary Disna. These are resources for the development of fisheries, tourism, as well as valuable water supplies.

The population of the Miorsky district in 01.01.2023 is 17963 people. 9,300 people live in cities, including 7,900 in Miora and 1,400 in Disna. The rural population is 9,800 people. The area is provided with highly qualified personnel.

Vacancies in the field of agriculture, construction, production have a priority place. The number of people employed in the economy of the district amounted to 8156 people.

Infrastructure

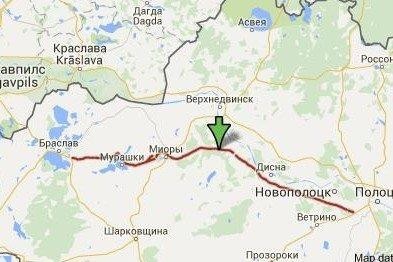

The highway R-14 to Latvia (Polotsk - Miory - Braslav) and R-18 to Russia and Lithuania (the border of the Russian Federation - Verkhnedvinsk - Sharkovschina - Kozyany) passes through the territory of the Miorsky district. The neighborhood with Braslav and Verkhnedvinsky districts provides the Miosra region with high tourist potential and attractiveness.

Р-14

There is a railway station in Miory, you can leave in four directions: Minsk, Vitebsk,Druya,Voropaevo.

The Miory substation was commissioned. The project was implemented as part of the construction of a plant for the production of metal sheet and white tin to ensure the reliability of the production facility and the uninterrupted supply of electricity.

On the territory of the Miorsky district, gasification of settlements is carried out.

Commissioning of the Miory-2 GRS UP Vitebskoblgaz

Industrial site and Real estate units

Preferencial Regimes

«INVESTMENT AGREEMENT WITH THE REPUBLIC OF BELARUS

Investment agreement with the Republic of Belarus allows the investor to get preferential conditions and benefits for the implementation of a certain investment project, establish additional guarantees to protect its capital.

Application terms:

- priority activities;

- amount of investment should exceed the cadastral value of a land plot.

Investor has the right to:

- rent a land plot from the list approved without auction;

- appoint a general engineering company without tender;

- full amount deduction of VAT;

- choose the suppliers of goods and service providers without established procedure;

- exemption from state due to general contracting and construction organization for the permits to engage foreign labour.

Investor is exempt from:

- payment for the right to conclude a land rental agreement;

- land tax or land rental payment for design and construction period;

- VAT and profit tax due to the gratuitous assignment of state property to investor;

- contribution to innovation funds for the agreement validity period;

- replacement of losses in agricultural and (or) forestry production;

- import customs duties and VAT while importing equipment and its spare parts at the customs territory of the Republic of Belarus for the investment project.».

Preferential conditions for commercial organizations carrying out production activities in rural areas were introduced by the current Decree of the President of the Republic of Belarus dated 07.05.2012 N 6 "On stimulating entrepreneurial activities in the territory of medium-sized, small urban settlements and rural areas" (hereinafter Decree N 6).

Decree No. 6 provides business incentives in rural areas for commercial organizations and individual entrepreneurs in terms of:

- payment of taxes (duties, duties) and customs duties,

- mandatory sale of foreign currency,

- obligatory conclusion of transactions at exchange trades during purchase of raw materials, components and materials for own production,

- foreign trade in goods of own production,

- Acquisition of State property located in rural areas.

General Terms of Benefits

The following categories of entities are entitled to benefits:

1) commercial organizations of the Republic of Belarus registered in the Republic of Belarus with their location in the territory of medium, small urban settlements, rural areas,

2) commercial organizations of the Republic of Belarus with separate subdivisions created on the territory of medium, small urban settlements and rural areas;

3) individual entrepreneurs registered in the Republic of Belarus with a place of residence in the territory of medium, small urban settlements and rural areas.

The benefits provided for in Decree No. 6 are applied provided that such commercial organizations, their separate units and individual entrepreneurs carry out activities for the production of goods (performance of work, provision of services) in the territory of medium-sized, small urban settlements and rural areas.

The benefits provided for in Decree No. 6 are applied by commercial organizations of the Republic of Belarus and individual entrepreneurs within 7 years from the date of their state registration.

Pursuant to paragraph 1, paragraph 1.8, of Decree No. 6, the benefits of Decree No. 6 do not apply to:

banks, non-bank credit and financial organizations, investment funds, insurance organizations;

professional participants in the securities market;

residents of free economic zones and the High-Tech Park, a special tourist and recreational park "August Canal," the Sino-Belarusian Industrial Park;

commercial organizations, individual entrepreneurs, separate units in terms of their implementation:

- real estate activities;

- gambling activities;

- lottery activities;

- the organization and conduct of electronic interactive games;

- production and/or sale of excise goods;

- production and/or sale of jewellery from precious metals and/or precious stones;

- manufacture of securities, banknotes and coins, postage stamps;

- activities within the framework of a simple partnership.

In accordance with the Decree, commercial organizations of the Republic of Belarus, individual entrepreneurs registered in the Republic of Belarus with their location (residence) in the territory of medium, small urban settlements, rural areas (hereinafter, unless otherwise provided by this Decree, commercial organizations, individual entrepreneurs), and carrying out activities in the territory of medium, small urban settlements, rural areas for the production of goods (performance of works, provision of services), within seven calendar years from the date of their state registration:

- The right not to calculate and not to pay income tax (commercial organizations) and income tax on individuals (individual entrepreneurs), respectively, in respect of profit and income received from the sale of goods (works, services) of their own production;

- are exempt from paying the state fee for issuing a special permit (license) for the performance by legal entities and individuals of certain types of activities (including those related to specific goods (works, services), making changes and/or additions to such special permit (license), extending its validity period (its);

- The right not to calculate and not to pay other taxes, fees (duties) real estate tax on the cost of capital buildings (buildings, structures), their parts, car places located on the territory of medium, small urban settlements, rural areas when carrying out activities for the production of goods (works, services) in the territory of medium, small urban settlements, rural areas;

- exempt from the compulsory sale of foreign currency received under transactions with non-resident legal entities and non-resident individuals from the sale of goods (works, services) of their own production, as well as from the rental of property;

- exemption from import customs duties and VAT on goods imported into the territory of the Republic of Belarus provided that the imported goods are classified according to the unified Commodity Nomenclature of foreign economic activity of the Customs Union in commodity items 7301, 7302, 7308, 7309 00, 7311 00, 8401 8408, 8410 8481, 8483, 8484, 8486, 8487, 8501 8519, 8521 8523, 8525 8537, 8543, 8545, 8601 8609 00, 8701, 8702, 8704 8707, 8709 8713, 8716, 8801 00 8805, 8901 8908 00 000 0, 9005 9008, 9010 9020 00 000 0, 9022 9032, 9103 9107 00 000 0, 9201, 9202, 9205 9208, 9401 9406 00, 9503 00 9508; goods are imported as a contribution to the statutory fund of organizations within the time limits established by the constituent documents for the formation of such a fund; the total value of the goods shall not exceed the non-monetary contribution specified in the constituent documents of the organizations.

The sale of goods (works, services) of our own production means:

- in relation to commercial organizations the sale of goods (works, services) of their own production during the period of validity of the certificate of products of their own production (certificate of works and services of their own production), issued in accordance with the procedure established by law to commercial organizations implementing their implementation.

- In addition, the Tax Code of the Republic of Belarus provides benefits for each tax (VAT, income tax, land tax, real estate tax, environmental tax, income tax and others) established by legislation.

In accordance with Decree No. 6, the investor's enterprise will have the following preferences:

Conclusion of a lease agreement on a land plot without purchase of the right to conclude such an agreement, as well as without holding an auction, and without payment for alienation of long-term plantations located on this plot;

- Possibility of installment payments for alienation of capital buildings and other immovable property under republican ownership in case of their alienation in favor of the enterprise to organize the production of goods (works, services);

- The possibility of financing from local budgets the costs of building engineering and (or) transport infrastructure for servicing real estate objects used for the production of goods (works, services).

In the Miorsky district, an investor can purchase unused state property at auction, including for one base value. The obligatory terms of the auction are the performance by the buyer of entrepreneurial activity at this facility. Land for servicing the said property is provided to the buyer on the right of lease without auction.

In addition, unused property can be transferred to the investor for free use for specific investment projects for the duration of their implementation. After the expiration of this period, unused property can be transferred to the ownership of the investor.

Preferences of small towns and rural areas

Investment proposals

Investment data sheet Miorsky district

Guide to investment